Nj Cash Buyers for Beginners

Table of ContentsNj Cash Buyers - TruthsGetting The Nj Cash Buyers To WorkThe 4-Minute Rule for Nj Cash BuyersThe Single Strategy To Use For Nj Cash Buyers

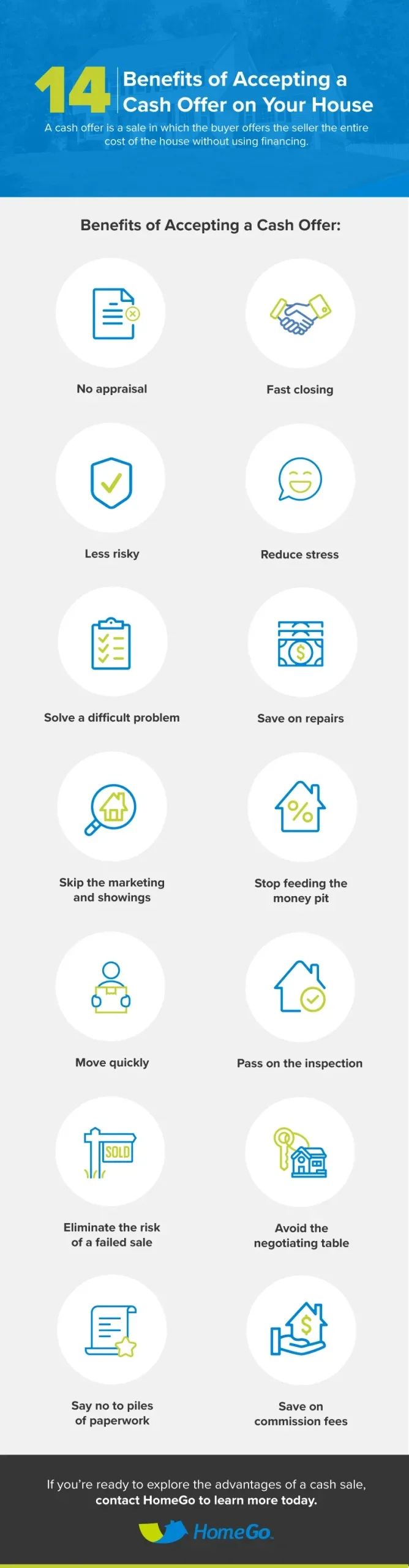

The majority of states give customers a certain level of defense from financial institutions regarding their home. Some states, such as Florida, entirely excluded your house from the reach of specific creditors. Other states set limits varying from as low as $5,000 to as much as $550,000. "That means, no matter the worth of your house, financial institutions can not force its sale to please their cases," claims Semrad.You can still go right into foreclosure via a tax lien. If you stop working to pay your residential property, state, or government tax obligations, you can shed your home through a tax lien. Buying a home is a lot easier with cash. You don't need to wait for an inspection, evaluation, or underwriting.

(https://www.startus.cc/company/nj-cash-buyers)I know that many sellers are a lot more likely to approve a deal of cash, but the vendor will get the cash regardless of whether it is funded or all-cash.

Nj Cash Buyers - An Overview

Today, concerning 30% of United States buyers pay cash for their properties. That's still in the minority. There might be some excellent reasons not to pay money. If you just have sufficient cash to pay for a home, you may not have actually any kind of left over for repair work or emergencies. If you have the cash, it may be a great concept to establish it aside so that you have at least 3 months of real estate and living expenses should something unexpected occur was losing a task or having medical issues.

You might have qualifications for an outstanding mortgage. According to a current study by Cash magazine, Generation X and millennials are taken into consideration to be populations with one of the most prospective for growth as customers. Tackling a bit of financial debt, especially for tax obligation purposes terrific terms might be a far better choice for your finances generally.

Maybe buying the securities market, common funds or a personal company could be a much better choice for you in the lengthy run. By buying a home with cash money, you take the chance of diminishing your reserve funds, leaving you vulnerable to unanticipated maintenance costs. Owning a property entails continuous costs, and without a home loan pillow, unanticipated repairs or renovations might stress your financial resources and impede your ability to keep the home's problem.

Nj Cash Buyers for Dummies

Home rates fluctuate with the economy so unless you're intending on hanging onto the residence for 10 to 30 years, you may be far better off spending that cash money elsewhere. Purchasing a home with money can accelerate the buying process dramatically. Without the need for a home loan approval and associated documentation, the transaction can close much faster, offering an one-upmanship in affordable property markets where vendors may like cash money buyers.

This can lead to significant cost savings over the long-term, as you won't be paying interest on the car loan amount. Cash customers commonly have more powerful settlement power when handling sellers. A cash money deal is a lot more attractive to vendors given that it minimizes the danger of a deal falling through because of mortgage-related issues.

Keep in mind, there is no one-size-fits-all remedy; it's important to tailor your choice based upon your individual circumstances and long-lasting goals. Ready to get started taking a look at homes? Provide me a phone call anytime.

Whether you're selling off assets for an investment residential or commercial property or are vigilantly saving to buy your desire house, acquiring a home in all cash money can considerably boost your purchasing power. It's a tactical relocation that enhances your placement as a buyer and boosts your versatility in the property market. Nonetheless, it can put you in an economically susceptible place (NJ CASH BUYERS).

The Single Strategy To Use For Nj Cash Buyers

Reducing passion is just one of one of the most usual factors to buy a home in cash. Throughout a 30-year home loan, you could pay 10s of thousands or perhaps thousands of countless dollars in total passion. Additionally, your purchasing power raises without any financing contingencies, you can check out a more comprehensive choice of homes.

The biggest risk of paying money for a residence is that it can make your finances volatile. Locking up your liquid possessions in a home can decrease monetary adaptability and make it extra difficult to cover unexpected expenses. Additionally, locking up your money suggests missing out on high-earning financial investment opportunities that can generate greater returns in other places.